Pre-arranged capital and momentum: Is real money being raised through online marketplaces?

- Written by Shaun Edlin

- Published on

Here is a high level view on investment trends across Snowball Effect's offers to date, and the factors that tend to have a positive impact on the successful ones. We look particularly at pre-committed capital and momentum.

Every offer has unique dynamics. For example, each industry and company risk/reward profile will appeal to different groups of investors. Some offers have better media coverage. Others will have a head start through a large existing customer or user audience.

We can't predict with certainty how investors will react to any given offer. However we've learnt some lessons from the offers that have been most successful in our marketplace. We've also picked up on similarities between the offers that haven't received as much investor interest.

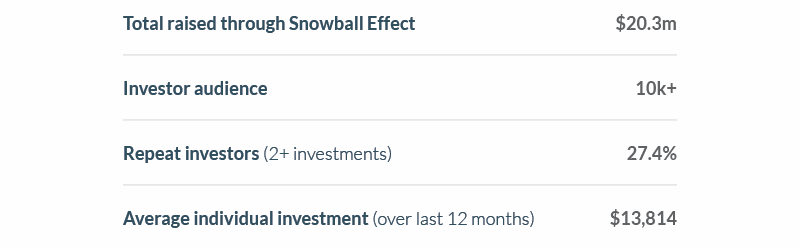

First though, here are a few investment statistics based on offers through Snowball Effect. Over the last 12 months we've seen a large increase (171%) in the size of individual investments. We believe this is due to investors becoming more familiar and comfortable with Snowball as a marketplace, some offers having higher minimum investments, and a focus on attracting experienced investors that tend to invest larger amounts. We've also seen an increase in the number of repeat investments. The people that are sticking, seem to be people that are more serious about increasing exposure to private equity in their portfolios.

It's worth noting that the minimum investment size is $1000 for many offers, so the average gets dragged down significantly by a long tail of small investments.

It's worth noting that the minimum investment size is $1000 for many offers, so the average gets dragged down significantly by a long tail of small investments.

Many companies commence their Snowball Effect offers with a portion of capital from investors who have already committed to invest. To date, an average of 15.8% of all investment through Snowball Effect has been pre-arranged before each offer has gone live. The balance has come from the Snowball Effect retail and wholesale investor databases, the general audience of the companies (such as customers), and the general public who become aware of the offer.

Pre-arranged capital can help to generate momentum early in the offer period. Some investors will only bother to read an offer properly if they can see some social proof from other investors. Some investors will feel more urgency if the offer is starting to fill up - they need to assess the offer and decide whether they're in or out before the opportunity is gone.

But the most important form of pre-arranged capital is that being invested by a credible lead investor. A credible lead investor is more than just someone injecting cash into the company. It's an individual or organisation that has a deep understanding of the investment proposition, and has a reputation for making successful investments in the relevant industry.

We encourage companies raising through Snowball to seek a credible investor to lead their offer. In some instances Snowball has sourced a lead investor from within our network of wholesale investors. Sometimes the details of a lead investment are included in the offer disclosure (if the investor is happy with that). This can be an important reference point for other investors.

Lead investors bring the following value to an offer:

To date, only three offers through our marketplace have failed to reach their minimum investment target. While investor feedback suggests that various factors may have influenced the lower investor demand for these offers, the one thing all three offers had in common was that they lacked a credible lead investor for the round.

It's early days for online investment in New Zealand, and we're still seeing very different investment patterns across offers. However, here are a few factors that tend to have a positive impact on investment during the offer:

We're pleased with how the online marketplace is maturing. A wider variety of deals are coming through (you'll see more on that in the next couple of months). Investment sizes are increasing. And repeat investments are increasing. This is partly due to the growth of our wholesale investor audience.

For those considering raising capital online, the most important part of offer preparation is to have an attractive proposition and high quality information. Once those grounding blocks are in place, it's time to work on the other aspects that can influence success such as pre-committed capital and initiatives to generate momentum.