Investor education series: Direct private equity investing #2

- Written by Piers Finch

- Published on

This series of articles aims to give investors a taste for the different measurement methods that professionals use, what some reputable historical studies say might be reasonable returns for this asset class and some tips on how to create a portfolio with the best chance of achieving them.

See Part 1 on calculating private equity returns here.

Blog 2 of 3: Analysing private equity returns

When it comes to private equity investing, investment returns is considered a taboo subject as the asset class is so risky. In some cases, the high risks can lead to high returns, but investors need to be wary of thinking that other people's average returns are a guide for how any individual investment will play out.

A lot of the figures used in this article are from overseas sources and may cover slightly different company stages and investing methods. We have aimed to select a wide range from angel, venture capital and private equity to cover a variety of companies and use local New Zealand data where possible. Finally, past performance is no guarantee of any future performance, in most endeavours, especially investing.

Realised vs unrealised

In the world of private company investing, a lot of the metrics you'll read about are based on estimated returns that have not yet been "realised" rather than actual returns. Estimated returns are useful because investments in private companies can take a long time to come to fruition and the price for a recent transaction, such as a capital raise, is a strong indicator of performance. However, until the money is back in your bank account - a "paper return" isn't yet an 'asset'. The below data looks mainly at fully realised returns, but it's also worth keeping your eyes open for unrealised returns whenever you're looking at returns data.

Average returns

Here are a few data points to reflect on when looking at investing in private companies, considering the returns that other investors have generated in the past:

Variability of outcomes

Whilst the average returns from large portfolios and funds are interesting, it's also worth understanding the wide range of outcomes that make up the averages. Seed stage investors, such as American investor Fred Wilson, say "Our target batting average is '1/3, 1/3, 1/3' which means that we expect to lose our entire investment on 1/3 of our investments, we expect to get our money back (or maybe make a small return) on 1/3 of our investments, and we expect to generate the bulk of our returns on 1/3 of our investments."

So, the earlier the investment stage, the higher the risk and the wider the spread in eventual outcomes. The distribution of returns for this type of asset class is quite varied. Analysis by the US Angel Association identified a wide range of performance for the investment exits in the study:

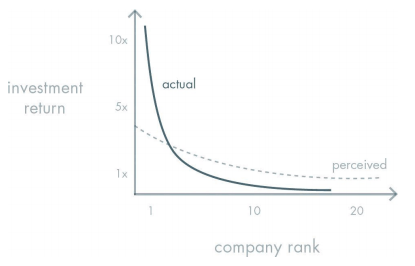

In New Zealand, we've seen recent returns to investors range from exits such as 2.5 times for SwipedOn after one year (an IRR of 250 per cent), to a total loss of all the capital invested. It's easy to assume that there's a nice smooth bell curve so that the returns most commonly land around the IRR "averages" discussed above, however, the distribution of private company returns more closely follows a "power curve" with a small number of high returns and a large number of negative or close to zero returns.

Armed with the information on realised returns, average returns and variability you are now better equipped to build a strategy for your own investments into private companies. The key tools include discerning due diligence, proactive diversification across industries, geographies and company stages, and forward planning for allowances to invest in follow-on funding rounds to back your winners.