Picking apart the FMA's 2018 online investment data

- Written by Toby Kelly

- Published on

The FMA has recently released their annual data insights into NZ's fintech space for the year ended June 2018. Of particular interest to us at Snowball Effect is how the online equity investment industry is continuing to develop, and whether the high-level data matches the trends that we are seeing day-to-day in the NZ capital markets.

The industry is growing, while getting more concentrated between providers

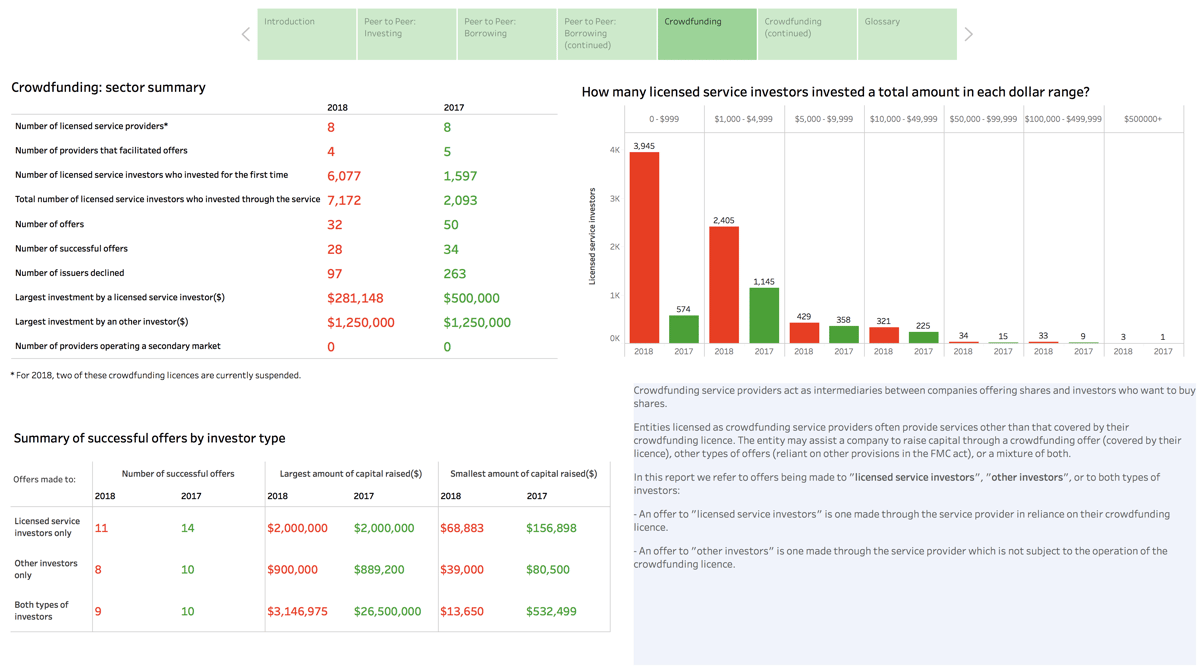

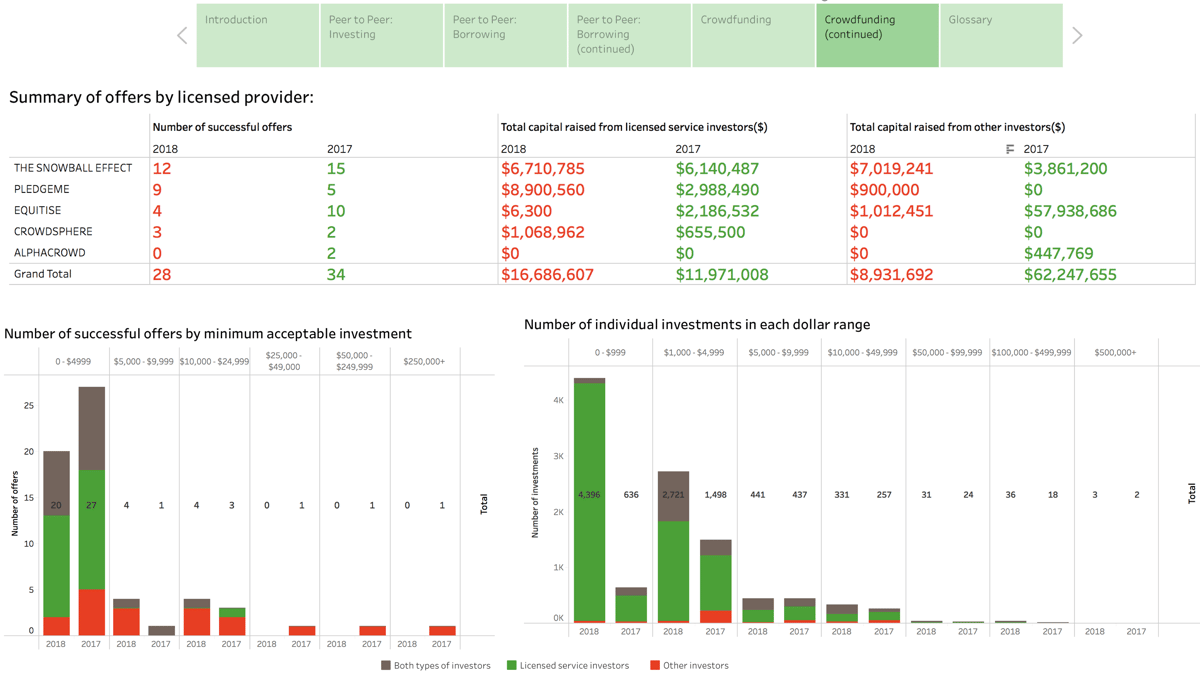

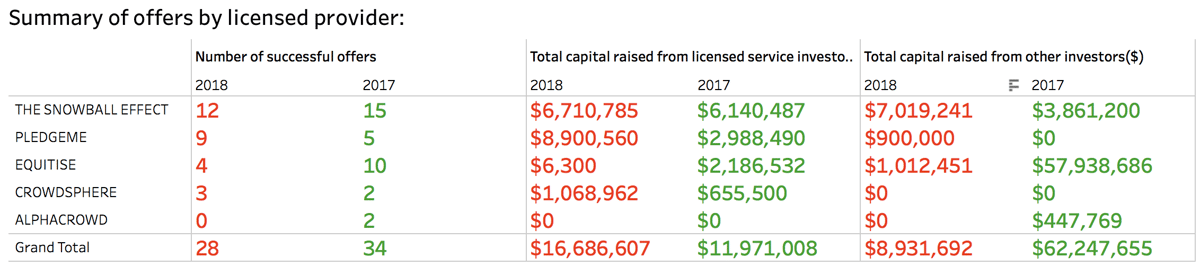

Licensed offers grew 39% this year compared to last year's figures, along with over 6,000 new investors. The number of licensed service providers remained constant at 8, but the number that actually facilitated an offer decreased from 5 to 4. PledgeMe (9) and Snowball Effect (12) dominated the market in terms of successful offers, while Equitise (4) shifted its focus to the Australian market. Snowball Effect raised $13.7m in total, PledgeMe raised $9.8m, with Equitise and Crowdsphere both completing approximately $1m in capital raised.

The industry is maturing and figuring out what best suits investors

This year had a much higher success rate for offers of 88% versus 68%, although on a lower tally for total offers of 32 versus 50. This suggests a higher level of curation and the recognition from platforms that time is best spent working with companies who have the highest chance of succeeding in a capital raise. The average deal size increased also, a likely signal towards larger companies raising capital through the platforms. Snowball has seen our largest capital raise ever with Link Business Brokers in 2018 of $3.46m and this shows how popular growth companies with established business models are, particularly with the experienced wholesale investor base. This follows on from Link's $3.15m capital raise in 2017, which is the biggest raise in the data set.

Bigger investors, making bigger investments

Speaking of wholesale investors, the year has seen a significant increase in the number of wholesale investors and capital being raised from wholesale investors outside of the 'equity crowdfunding exemption' by online platforms. There is also an interesting split emerging in the market, as Snowball focuses more on these types of offers and our competitors continue to target the retail type raises. Snowball raised 48 percent of its total capital raised from retail investors through licensed service offerings, with the 52 percent balance being wholesale investors. This compares to an industry average of 65/35 percent retail/wholesale and a 91/9 percent retail/wholesale for PledgeMe. There may be some noise in this data as we are unsure on how other platforms monitor and allocate wholesale investors. At Snowball, it is a key part of our process for deal terms and valuation to be tested with cornerstone investment from wholesale investors before taking the offer public to a retail audience, which requires tracking each bucket that an investor falls into before engaging them.

Things we'd love to see for 2019

As the wholesale portion of the market continues to grow and equity crowdfunding becomes more integrated with the traditional forms of capital raising for growth companies in New Zealand, we'd love to see more industry-wide figures that pull together the different parts of the private capital markets ecosystem. While the NZ capital markets are small, there's still a wide mix of data produced between the Annual Angel Association figures (produced with PWC), the great work done in the annual Technology Investment Network Report and the FMA's industry snapshot of the online investment industry. The 'funding gap' for NZ startups and SME's continues to be a hot topic in the NZ business media and some collaboration across these sources would be great to provide a more fulsome industry snapshot to push the conversation forward with data-driven insights.